PPI issuer must pay 15 bps as pockets loading carrier fee to the remitter’s financial institution for loading over INR 2,000 within the pockets

As confusion prevailed over whether or not the interchange charges would observe to P2P transactions, NPCI mentioned that financial institution account-to-account UPI transfers will proceed to stay unfastened for patrons and retailers

The transfer is noticed through many as the federal government laying the bottom for a long term advent of MDR on P2M UPI bills

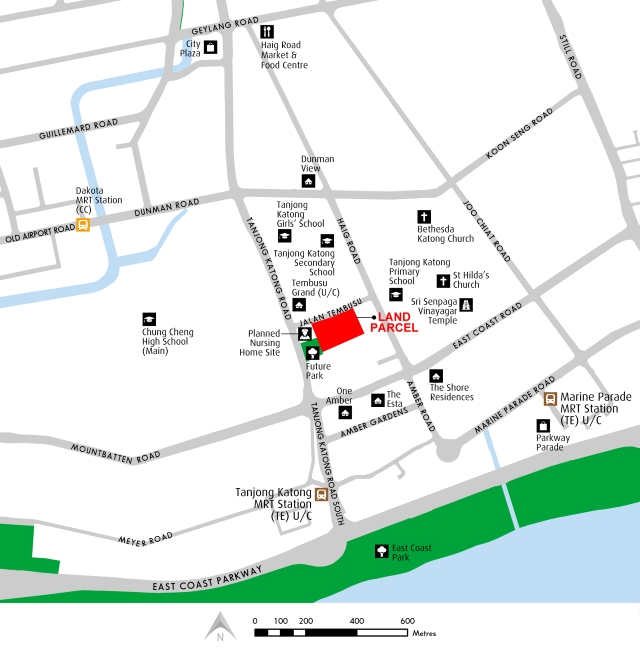

On March 24, the Nationwide Bills Company of India (NCPI) issued a round announcing that Unified Bills Interface (UPI) transactions of above INR 2,000 made thru pay as you go cost tools (PPI) to retailers will draw in an interchange commission of one.1%.

Whilst the round in large part went disregarded first of all, a observation through Paytm announcing it’s smartly poised to leverage the announcement introduced the round beneath the highlight.

The round, which can come into impact on April 1, famous that peer-to-peer (P2P) and peer-to-peer-merchants (P2PM) transactions is probably not coated beneath the ambit of the brand new fees.

As in step with the NPCI, P2PM transactions are categorized as transactions with small retailers who’ve projected per month inward UPI transactions of lower than or equivalent to INR 50,000.

The interchange commission will best observe on bills made to on-line retailers, huge retailers and small offline retailers.

Within the card cost business, interchange commission is the fee that retailers pay to issuer banks for each and every credit score and debit card transaction. The associated fee covers prices associated with authentication, verification and processing methods at other ranges of debit and bank cards transactions.

In the meantime, PPIs are tools that facilitate acquire of products and products and services, behavior of economic products and services, permit remittance amenities, amongst others, in opposition to the price saved therein. Merely put, cellular wallets, present playing cards, pay as you go playing cards, amongst others, are PPIs.

As in step with the round, the interchange commission can be decrease for positive kinds of retailers. Whilst UPI bills over INR 2,000 by the use of PPIs will best draw in an interchange commission of 0.5%, bills associated with utilities, training and telecom will incur a commission of 0.7%.

The NPCI round additionally mentioned that PPI issuers could be vulnerable to pay 15 foundation issues (bps) as pockets loading carrier fee to the remitter’s financial institution (account holder’s financial institution) for loading over INR 2,000 within the pockets.

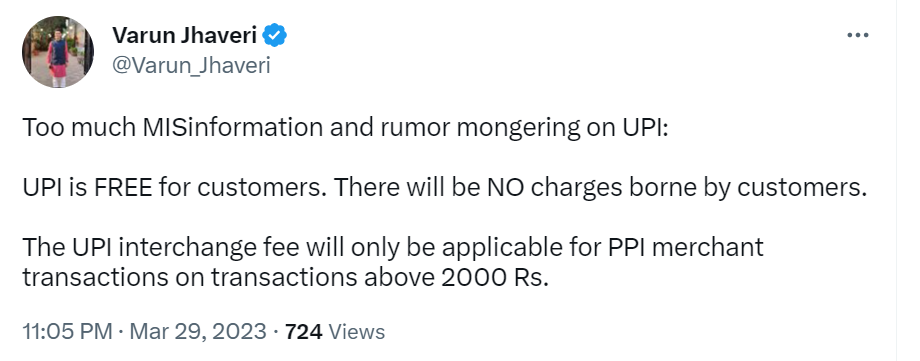

Because the round got here into limelight, panic gripped many social media customers as they idea they must endure the interchange commission for all UPI transactions above INR 2,000.

To soothe the worries, the NPCI, in a observation, on Wednesday, mentioned that financial institution account-to-account UPI transfers account for greater than 99.9% of the whole UPI transactions and those transactions will proceed to stay unfastened for patrons and retailers.

“… The interchange fees presented are best appropriate for the PPI service provider transactions and there’s no fee to consumers, and it’s additional clarified that there are not any fees for the checking account to checking account founded UPI bills (i.e. standard UPI bills),” the observation added.

Simplifying Jargon

Let’s perceive what the announcement method with a easy instance.

If a shopper rather a lot his/her Paytm pockets with INR 3,000 by the use of his financial institution, say Axis Financial institution, then Paytm could be required to pay 0.15% of the volume, i.e. INR 4.5 to the financial institution. On the subject of Paytm, if the remitter financial institution is Paytm Bills Financial institution, there could be no fees.

Subsequent is the pockets interoperability factor. On the service provider’s finish, there will also be two situations:

- A client will pay by the use of a pockets, say Paytm, to a service provider having QR code related to Paytm pockets. On this case, no interchange can be levied

- A client will pay by the use of Paytm pockets (PPI Issuer) to a service provider having QR code related to another pockets, say Mobikwik. On this case, Mobikwik (PPI Acquirer) must pay 1.1% of the whole transaction quantity to Paytm as an interchange commission.

Now, right here once more there will also be two situations:

- Mobikwik will proceed to endure the price of holding the service provider on board

- Mobikwik will cross at the 1.1% price to the service provider.

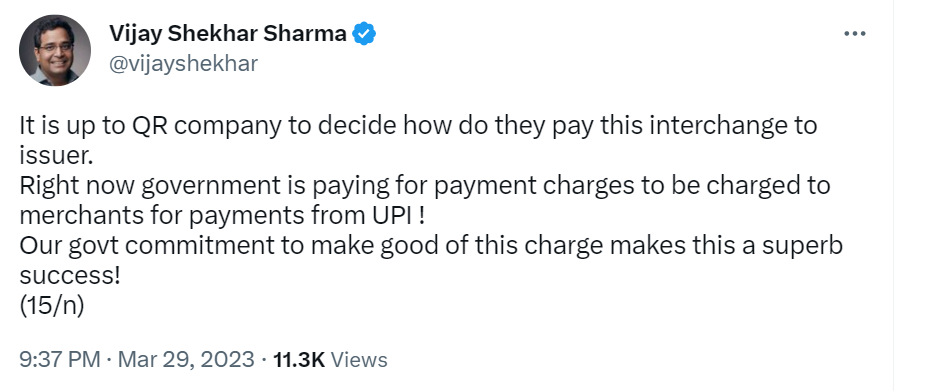

Explaining this, Paytm cofounder and CEO in a Twitter thread mentioned, “Consider there’s NO fee to client for UPI bills from checking account or from wallets (or from RuPay bank cards). For service provider — ONLY if they comply with settle for and alright to pay any fee levied through QR corporate, they’re going to be activated.”

Affect on Pockets Issuers & Traders

The largest factor in entrance of waller issuers seems to be the pockets loading carrier fee that might run into tens of crores. A document through brokerage Citigroup estimates that such fees may just run into INR 100 Cr for pockets issuers and would in large part move to banks.

“In keeping with Feb’23 annualised pockets cost transactions of INR 2 Tn, we estimate pockets loading fees may well be >INR 1 Bn throughout all pockets issuers (assuming 30% of pockets transactions are eligible given transaction-size rule and an estimated 60% percentage of UPI in wallet-loading), and can be paid to banks,” the document mentioned.

There seems to be apprehension round small retailers with an annual turnover of lower than INR 40 Lakh over the interchange commission. On the other hand, these types of small gamers or native distributors have a mean transaction sizes in large part beneath the edge quantity of INR 2,000.

On the other hand, issues can get difficult on the finish of on-line and big offline retailers. In keeping with an business supply, those retailers are already coated through the MDR regime and procedure bills thru different PPI tools comparable to bank cards, which fee the interchange commission on the price of one.8%. This, the supply mentioned, may just complicate issues for such gamers and saddle them with further compliances and costs.

Then there’s the problem of on-line retailers comparable to ecommerce platforms and foodtech gamers the usage of the brand new regime to fee upper service provider bargain price (MDR) to their companions. In keeping with business professionals, those platforms may just deduct upper MDR from their companions’ wallets whilst processing bills, which might immediately have an effect on the purchasers.

Level Set For MDR Regime?

Remaining yr, the Reserve Financial institution of India (RBI) floated a dialogue paper which mooted the speculation of MDR on UPI bills. It brought about a furore on social media as customers mentioned that the advent of MDR would put pace breaks at the UPI juggernaut.

Following this, Finance Minister Nirmala Sitharaman mentioned that no such proposal for introducing MDR on UPI bills used to be beneath executive attention. Afterwards, the Centre additionally introduced an INR 2,600 Cr incentive scheme to advertise RuPay debit playing cards and low-value BHIM-UPI transactions beneath INR 2,000 for the monetary yr 2022-23 (FY23). With this, the Centre necessarily bears part of MDR for low-value UPI transactions.

On the other hand, the advent of interchange charges for service provider transactions is being noticed through many as the federal government laying the bottom for a long term advent of MDR on P2M UPI bills.

“… the newly outlined interchange charges may just result in upper MDRs imposed on retailers’ pockets transactions finished by the use of UPI-rails. Fee firms skill/willingness to cross on interchange charges as upper MDRs can be a key factor to observe. Additional, does this additionally lay floor for a long term advent of MDRs on all UPI P2M transactions?” mentioned Citigroup in its document.

Whilst there’s a lot at stake, it continues to be noticed how the problems pan out over the process the following few days and if the Centre gives any rationalization at the subject. For now, the ball is within the NPCI’s courtroom.

Supply By way of https://inc42.com/buzz/explained-npcis-interchange-fee-for-ppi-based-upi-transactions/