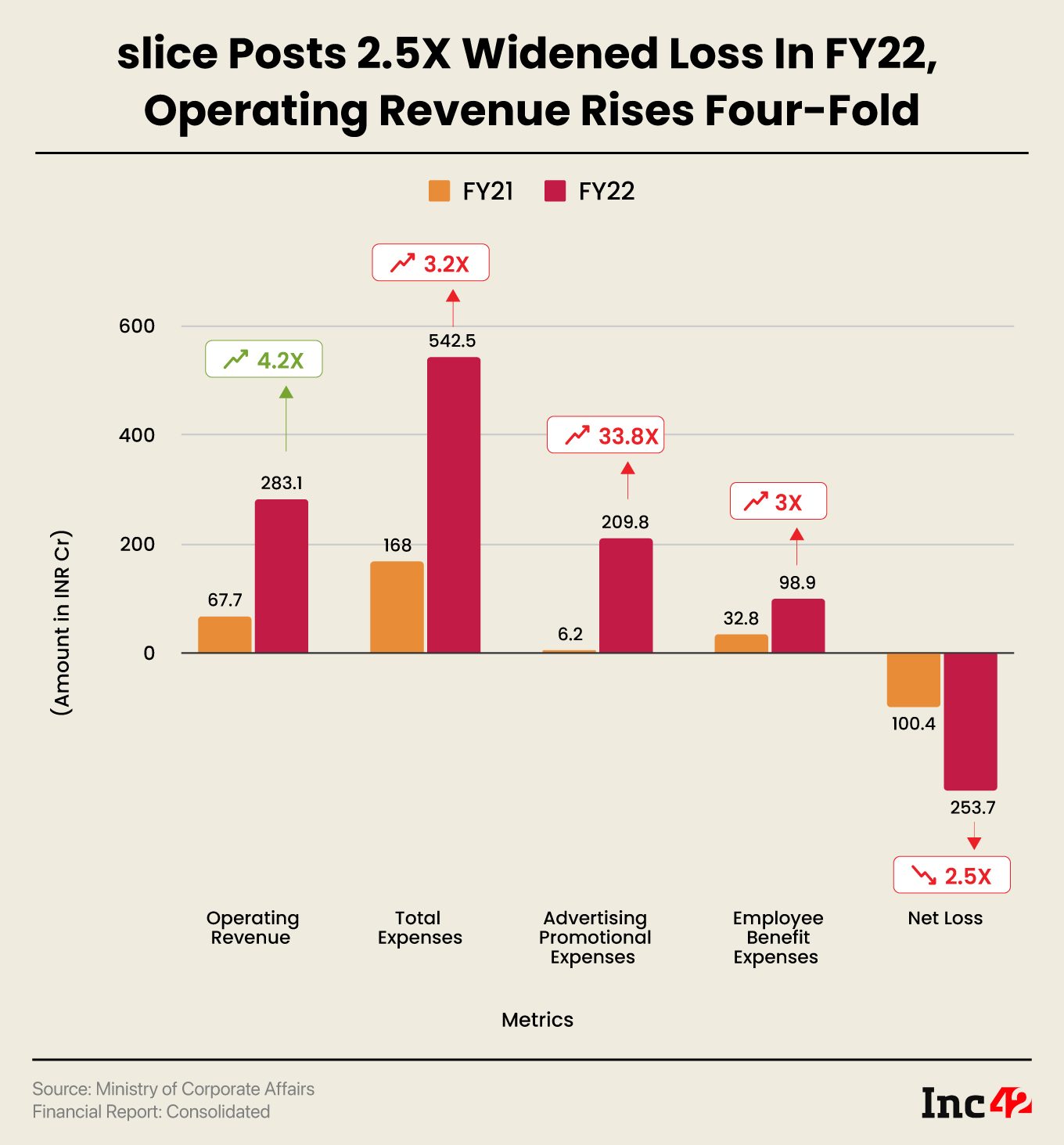

The fintech startup’s running income grew 4.2X YoY to INR 283.1 Cr in FY22

Promoting and promotional bills ballooned 33.8X to INR 209.8 Cr right through the yr

The RBI’s choice in June remaining yr to bar NBFCs from providing credit score on PPI dealt a significant blow to slice

Bengaluru-based fintech unicorn slice’s consolidated web loss widened 2.5X to INR 253.7 Cr within the monetary yr 2021-22 (FY22) from INR 100.4 Cr within the prior fiscal yr, harm through a vital surge in promoting bills.

Then again, the running income of the fintech startup, basically based as a lending platform catering to scholars and younger adults, jumped 4.2X to INR 283.1 Cr from INR 67.7 Cr in FY21.

slice (previously Slicepay) used to be based in 2016 through Rajan Bajaj. In FY22, the fintech startup operated as a purchase now pay later (BNPL) platform, providing a credit score card-like pay as you go cost software (PPI) without a annual fees, no hobby, and no past due charges. Then again, it stopped this providing remaining yr following regulatory problems. Extra about this later.

As in keeping with its FY22 regulatory submitting, slice earned income basically from web dealing with charges, fee source of revenue from the services and products equipped via its on-line platform, and hobby and fee source of revenue from credit score amenities equipped to folks.

slice earned about INR 149 Cr as price and fee source of revenue in FY22 as in opposition to INR 42.1 Cr in FY21. Then again, its hobby source of revenue on loans stood at INR 134.1 Cr within the yr beneath overview in comparison to INR 25.6 Cr within the prior fiscal.

Overall source of revenue rose 4.3X year-on-year (YoY) to INR 292.9 Cr in FY22.

It should be famous that the startup additionally entered the unicorn membership in FY22 after elevating $220 Mn in its Sequence B investment spherical led through Tiger World and Perception Companions. Months previous to that, in June 2021, slice raised $20 Mn in a contemporary fairness investment spherical led through Blume Ventures and Gunopsy Capital.

Amidst the sturdy enlargement in industry and new investment rounds, slice’s expenditure against promoting and promotions jumped a whopping 33.8X to INR 209.8 Cr in FY22 from INR 6.2 Cr within the earlier fiscal yr.

Promoting bills accounted for 74% of the running income right through the yr beneath overview. Actually, slice introduced a number of new promoting campaigns centered against GenZ in FY22. It additionally rolled out an advert marketing campaign for the 2022 consultation of Indian Premier League (IPL).

In the meantime, slice’s overall bills rose to INR 542.5 Cr from INR 168 Cr in FY21. Worker receive advantages bills tripled to INR 98.9 Cr from INR 32.8 Cr in FY21. Of this, it spent INR 86.1 Cr against salaries and wages and INR 8.3 Cr against worker share-based bills.

The startup’s finance value additionally grew to INR 65.1 Cr in FY22 from INR 7.6 Cr in FY21. Overall impairment value surged ninefold YoY to INR 60.8 Cr.

slice gained a significant blow in June remaining yr after the Reserve Financial institution of India (RBI) barred NBFCs from providing credit score on PPI. Because of this, the unicorn close down its vertical providing pay as you go bank cards. Amid the confusion round its industry type following the RBI’s motion, slice hived off its bills and credit score companies into two separate verticals.

Previous this month, studies emerged about slice obtaining a 5% stake in Guwahati-based North East Small Finance Financial institution for $3.42 Mn (INR 28 Cr).

Whilst India’s fintech marketplace is predicted to achieve a measurement of $2.1 Tn through 2030, rising at a CAGR of 18% from 2022, mounting losses proceed to pose a significant problem for the startups within the sector. Fintech unicorn OneCard’s web loss widened over 5.5X to INR 183 Cr in FY22, whilst BNPL startup ZestMoney’s loss grew 3X to INR 399 Cr right through the similar yr.

In the meantime, studies emerged on Thursday that PhonePe has cancelled its plan to obtain ZestMoney.

Supply By way of https://inc42.com/buzz/fintech-unicorn-slices-fy22-loss-surges-2-5x-to-inr-254-cr/