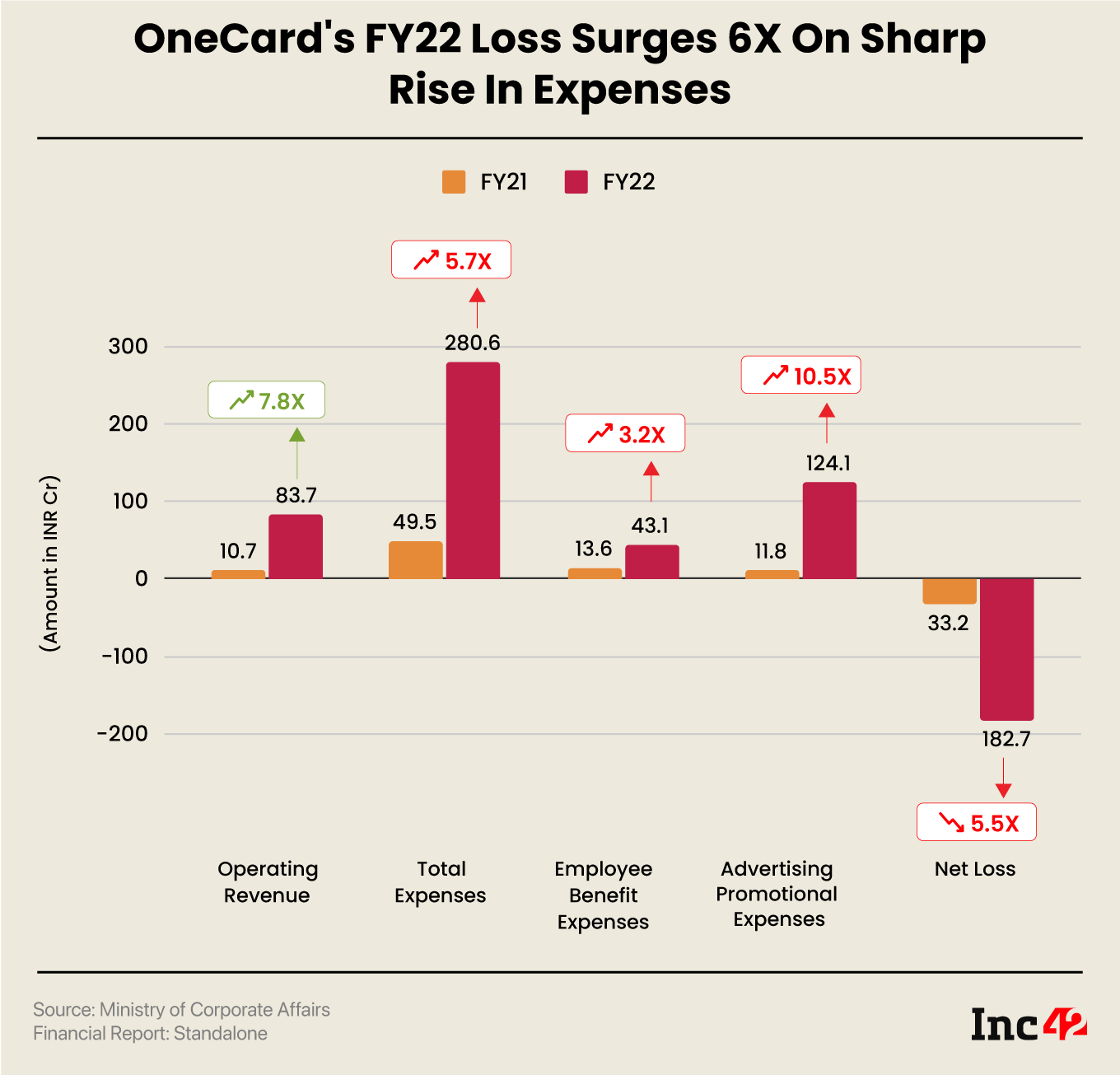

OneCard’s income from operations grew 7.8X to INR 83.78 Cr from INR 10.78 Cr in FY21

The Pune-based fintech startup’s overall bills ballooned 5.7X YoY to INR 280.61 Cr in FY22

Promoting promotional bills noticed a whopping 10.5X YoY upward thrust to INR 124.16 Cr

Pune-based OneCard’s web loss widened over 5.5X to INR 182.76 Cr within the monetary yr 2021-22 (FY22) from INR 33.19 Cr within the earlier fiscal yr as its bills surged, in keeping with the expansion in industry.

The fintech unicorn’s income from operations grew 7.8X to INR 83.78 Cr from INR 10.78 Cr in FY21. The startup, which leverages generation to release bank card and different IT-enabled monetary answers in partnership with banks and fiscal establishments, earned its complete working income from sale of services and products.

Overall source of revenue, together with different source of revenue, grew 6X to INR 97.85 Cr from INR 16.39 Cr in FY21.

In the meantime, overall bills ballooned, led via a pointy building up in marketing and promotional bills. OneCard’s overall bills rose 5.7X to INR 280.61 Cr in FY22 from INR 49.58 Cr in FY21.

Different bills, which integrated hire, insurance coverage, marketing and promotional bills, amongst others, accounted for the largest bite of bills. The fintech startup’s different bills rose 6.6X to INR 235.12 Cr from INR 35.5 Cr in FY21.

Promoting promotional bills noticed a whopping 10.5X upward thrust to INR 124.16 Cr in FY22 from INR 11.8 Cr within the earlier monetary yr.

Worker receive advantages bills grew 3.2X to INR 43.17 Cr from INR 11.18 Cr within the earlier yr.

OneCard, based in 2018 via Anurag Sinha, Rupesh Kumar and Vaibhav Hathi, problems co-branded bank cards in partnership with the likes of South Indian Financial institution, Federal Financial institution, BoB Monetary, and SMB Financial institution. It introduced its first cellular steel card in 2020. The startup additionally gives OneScore, a virtual credit score rating platform providing unfastened credit score rating assessments.

OneCard entered the unicorn membership closing yr after it raised about $100 Mn (about INR 802 Cr) in a investment spherical led via Singapore’s sovereign fund Temasek. The startup has raised $227 Mn investment up to now and is sponsored via marquee names like GIC, QED Buyers, and Sequoia Capital.

OneCard competes with the likes of Slice, Karbon Card, Uni Card, Kodo Card.

Previous this month, OneCard filed a cyber fraud criticism with the Delhi Police after 5 fraudsters duped the startup via shopping merchandise price INR 21.32 Lakh by way of bank cards. The fraudsters used PAN main points and names of Bollywood actors and celebrities to get OneCard bank cards.

Supply Via https://inc42.com/buzz/fintech-unicorn-onecards-fy22-loss-widens-5-5x-to-inr-183-cr-as-advertising-cost-surges/